Welcome from Colleen

Welcome to our new members – thanks for supporting Grey Power’s advocacy.

Grey Power is at an interesting crossroads. Many of the 74 Associations have busy programmes planned for the year while others – even some with large memberships – are struggling to attract committee members.

Wellington Central Grey Power Committee and Federation Groups

The Wellington Central Committee of five committed members represents you, our members, locally as well as at Zone and Federation levels.

The Committee seeks new members, especially a Treasurer and Secretary . The work is not onerous. The Committee meets at The Hub, Mt Victoria, at 1pm on the 1st Monday of February to November with a social meeting in December. Please give some thought to how you can contribute to advancing Grey Power’s advocacy for seniors.

The Grey Power Federation has specialist National Advisory Groups listed below. Any member interested in contributing to their work could call me 027 200 0066 or email me at president@greypowerwellington.org.nz

- Aged care and Retirement Villages

- Energy

- Fifty Plus

- Health

- ACC

- Law and Order and Emergency Management

- Local Bodies, Housing and Transport

- Retirement income and taxation

As Chair of the Federation’s Communication/Marketing Standing Committee, I welcome hearing from any member who has experience in negotiating commercial agreements/contracts for member discounts.

Annual General Meeting

We are preparing for the AGM, which will probably be held toward the end of May.

Public meetings

Over the past couple of years the Committee has held public meetings inviting members and the public through an advertisement in The Dominion Post. While the ad is expensive it has given us the opportunity to introduce members of the public to Grey Power. We plan to continue that this year.

Grey Power Electricity

The relationship Grey Power Federation has with Grey Power Electricity brings benefits to both individual members and the Federation. https://www.greypowerelectricity.co.nz/ for further information about electricity and broadband services.

The Federation Board’s election strategy

The Board is developing its election strategy, which should be available to all members following the early May Board meeting. As we are all aware, the cost of living is a major item for seniors and I’m sure there will be messages about that for us to take to our local candidate meetings. Housing is still an issue in Wellington with some of the emergency housing being less than appropriate, especially for children.

The Board is also continuing to develop a strategic plan. To assist with the direction of the plan you may be asked to complete a random member survey regarding Grey Power. The previous survey in June 2022 on how Grey Power members were coping on NZ Super was reported in the last two Grey Power Magazines for 2022. The link to those reports is https://greypowermag.co.nz/category/superannuation/

Looking forward to seeing you at our AGM.

Colleen Singleton, President

Will you still drive me when I’m 75?

When you reach the venerable age of 75 the state deems you unsuitable to drive without getting tested, medically and psychologically. You’re normally sent a reminder before the date, but if you had put your work address in the system you may not get the reminder and have to start the process yourself. Your first port of call is your doctor, where you will be given a preliminary test by a nurse, and then you will be passed on to the doctor. This costs around $115. The test includes a vision test, but it might be worth getting an optician (free at Specsavers if you’re an AA member) to do the job. ( I was told I didn’t need to use glasses while driving any more; score!). You then take the paperwork to the AA office in Lambton Square where for $18.70, and another form they take your photo and issue you with a temporary licence. The real licence arrives about a week later.

Now you’re good to go until the even more venerable age of 80.

Owen Watson

NB: there’s a good piece in the latest national Grey Power magazine about whether these tests are fit for purpose.

We need a Big Idea

Perhaps Grey Power (GP) could partner with the Red Cross and go out into the towns, cities, and retirement communities to collect money for the Red Cross Cyclone Gabrielle relief fund.

As an organisation, we’ve had a long list of achievements but I think we need a big idea now to engage other people, re-capture the imagination of our members and inspire more older people to join us.

Such an exercise would showcase older people as a vital part of the community. This would also be incredibly good for our brand. Boomers mobilising to give back is a strong message to send especially after the Covid action that was taken to protect our age group.

Being part of this wider relief would give us a lot more mana to pursue our own advocacy work later.

Presumably, the Red Cross hasn’t got the numbers to push out collectors into the community so sends messages to get people to donate through its website. They may well welcome our involvement.

As a member organisation, our strengths seem to be our geographical reach nationally and our strong organisational branding. Perfect prerequisites for a big idea.

I can imagine myself sitting behind a table in Lampton Quay sporting a banner saying something like, Grey Power and Red Cross join together to help New Zealanders. Are you in?

I would wrestle cheerfully with the EFPTOS machine and happily sit in my coat if it was cold. There would probably need two of us at each table for practical reasons and to make it fun. We might even be able to sign up a few new members, get local and national media coverage and feel good about ourselves because we are doing something of practical use.

Why did I join GP?

I didn’t join GP for cheaper electricity I joined because I think it’s important for people to have a forum to advocate for themselves and others who face similar issues.

As I write this piece, I’m casting around for the active roles available for someone like me who isn’t really interested in being part of a local committee. I looked at the GP Federation information online but that didn’t give me the information I was looking for so when the printed NZ Grey Power Magazine arrived by post I was excited.

And promptly disappointed.

The two issues I’ve read are full of advertisements targeting older people and really thin on content.

I’ve wanted to read articles that inform me about relevant issues, engage me in the work GP is doing, inspire me to participate and encourage my friends to join.

The magazine is the most valuable communications tool the organisation has because it’s printed and posted to members who may not go online to get their news.

Are we an organisation where members do nothing?

These issues make me feel as though GP is an organisation where members are expected to do nothing except maintain organisational form (through committee work) and enjoy cheap electricity.

There are few pathways laid out nationally for members to be active. And GP employs no paid staff to engage with members or coordinate campaigns. I can’t shovel silt any longer (I don’t know whether I ever could) but I still feel part of this country and I want to belong to an organisation that can provide me with real opportunities to contribute as an older person.

Do others feel the same?

Sally Champion

Cheaper Council rates

If you’re on a low income and pay rates, you may be eligible for a subsidy of up to $700 on your rates. You must apply by June 30th; check out the details here: https://www.govt.nz/browse/housing-and-property/getting-help-with-housing/getting-a-rates-rebate/

Grey Power electricity: don’t send us the money

Some members pay their electricity bills into our account. Please don’t; we have to reverse out the transaction and notify you, which takes time.

Grey Power subs: do send us the money (but not quite yet!)

Subscriptions are now due for the year to 31/3/24. We will send out a subscription reminder in a few weeks, except for those with no email address who will get one with the printed newsletter. Please wait till you receive the reminder before paying; one of the banes of our treasurer’s life is refunding subs that have already been paid. If you’re uncertain if the sub has been paid email membership@greypowerwellington.org.nz and we’ll be in touch.

Where there’s a will there’s a way . . . of disputing it

Inheritance law is set for a major shakeup after 140 recommendations by the Law Commission.

Should the recommendations make their way into the new simplified law, this could leave some who hope to inherit family wealth with a bitter taste.

NZ Herald senior writer Jane Phare tells the Front Page podcast that these changes were 70 years in the making.

Under the recommended changes, Kiwis who have fallen out with a parent and are cut out of their inheritance, will not be able to contest the decision. “Under the new law, if you’re over 25, you will not be able to contest the will.

If Mum or Dad leave it all to the SPCA or your brothers and sisters, well, that’s tough.” says NZ Herald’s Janet Phare.

Legal opinions about this law have been divided.

The Law Commission came up with several recommendations to reflect those conflicting concerns, one of which (Recommendation 25) presented two options for reform. Under one of those options, children over the age of 25 would be ineligible to claim family provision unless they had a disability. The other option would enable all children and grandchildren of the deceased, regardless of their age, to claim

Another change recommended is that stepchildren should be given the power to make a claim. “They don’t say how much, so it’s a little open-ended, but they do allow for the possibility.” says Phare. This could open the door to a whole new category of litigation between biological children and stepchildren all looking to assert their rights to inheritance. “One of the reasons to bring these statutes under one law was to make it easy, accessible, and clear. But in areas like this, where biological children become angry and defensive against stepchildren, it does open it up for more court action and hostility within the family unit.” Phare explains that a major motivation behind these changes is that the dynamic of the modern New Zealand family is far removed from what it was seven decades ago. “Back when the inheritance laws were written, there was Mum, Dad and the two kids. That’s not a reflection of modern-day society, where re-partnering is much more common and there’s often one or more sets of children from previous relationships. That needs to be taken into account.”

Trusts, long used by wealthier individuals to protect their assets, also look set to feel the impact of the recommendations from the Law Commission. “Under the current law, if a property falls outside the estate, nobody can touch it,” says Phare. “The Law Commission wants the court to have greater power to access trusts.” Phare says that if there is clear evidence that someone intended to use a trust to hide their assets to stop someone from inheriting, then there could be grounds for a claim under the new law. “There has to be intent and you (have) to prove that intent to the court, so it is a reasonably complex area,” she says.

Raising further concern is the Law Commission’s recommendation when it comes to separated couples. “In the event of separation, if one of the partners dies, the surviving partner can claim up to two years after the date that they separated,” says Phare. “They can make a claim against the estate, and the court can make that longer. If they presented a strong enough case, they could make that up to five years since separation.” Phare says although the law might seem controversial, it does serve a practical purpose. “You can’t get divorced legally until you’ve been separated for two years. And often, property settlement takes longer than two years, so it could be to protect people who are still waiting to get their share of the matrimonial property.”

Damien Venuto/NZ Herald

Staying in your home rather than going into care

In 2002 a New Zealand policy directive named “Ageing in Place” was established with a view to supporting older people to remain in their own homes rather than having to move into residential care. In order to achieve the strategy an integrated approach to health and disability support services was proposed.

On balance, this strategy has been successful and has allowed many older New Zealanders to remain in their own homes and keep the independence that is so important later in life. However, since COVID it has become increasingly difficult to maintain the levels of health and support systems that are required.

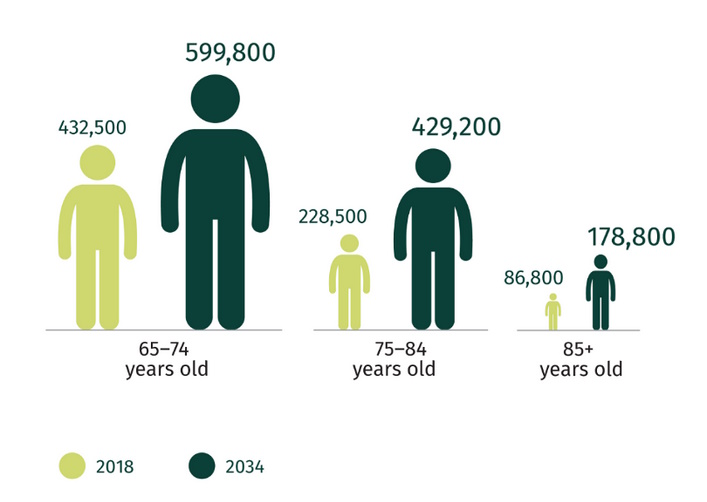

Recent research indicated that 81% of 45-64 year olds live in a stand-alone house or town house and 66% would prefer to live in this type of housing for life. The ability to age in place is being further tested as the first of the baby boomers start to reach retirement age and look for low maintenance homes with fewer bedrooms and smaller gardens than the big family homes that they currently occupy. The changing population age demographic is well illustrated in Figure 1.

Figure 1: 65+ population 2018/2034

The ability to successfully age in place is largely governed by five key areas:

- Suitability of housing

- Good physical and mental health

- Community health services

- Strong social networks

- Public transportation

A variety of housing is available for those looking to downsize however there is often a waiting time for the most suitable housing. Many of the retirement villages and 55+ villages are full and have waiting lists. Smaller freehold homes can be difficult to find, especially those with facilities suitable for older people. There are advocates for a universal housing design. However these designs can be expensive, are still rare, and consequently it can be difficult to find a home that meets the special needs that advancing age can bring.

When looking for a smaller home or assessing the suitability of your current home there are several key areas to check. Firstly, easy access, single level, wide doorways and wheelchair access to a bathroom and a shower with grab rails.

Maintaining a healthy lifestyle in combination with good genetics and a little bit of luck gives older people the best chance of ageing in their own homes. Many people will have a time when they may need to recover from a significant illness or injury. Have a plan in place in case you need to recover from an accident to increase the chance of being released from hospital and back to your own home.

There is some onus on the individual to maintain their social networks, whether that is with family, friends or community connections. Technology is helping many to keep in touch with their networks by using Facebook, WhatsApp, Facetime and other similar online applications. Many people find that it is easier to make and keep friends by being active in a sport or a hobby such as golf or bridge. Volunteering is another worthwhile avenue to create community connections; many local community groups are searching for volunteers and will be delighted to meet you. Grey Power will welcome you to monthly meetings and supporting Grey Power will help us to advocate for older New Zealanders.

Knowing that there is public transport available can take the pressure off when driving becomes difficult or impossible. In some cities there are senior drivers and community organisations that will take older people to and from medical appointments.

If you are one of the New Zealanders that like the idea of aging in place then it is important to create a plan for your home that covers the five key areas above so that if circumstances change you are well positioned to stay at home and in your own community.

Vanessa Charman-Moore/Tauranga & BOP Branch

Village life not good for everyone

Nothing has highlighted the inequities caused by the loss of capital gain in retirement villages as much as the dramatic property price increases of the past few years, so it is timely that the Retirement Villages Act 2003 review is being started in 2023.

The following story provides a good example of how loss of capital gain can trap residents in a village. A Tauranga couple sold their lovely, large family home 10 years ago and bought into a local retirement village. The price they paid was in the $400,000’s and they were told there would be care facilities available in the future. The care facilities never eventuated and 10 years later when they needed support, they found that they were unable to afford to move as their original purchase price, less a 30% deferred management fee, left them well short of current housing costs. They were not ready to be assessed as requiring residential care. As luck would have it, a large village group bought their village and they were able to transfer to another village (within the same group) that was able to meet their current and future needs.

This raises the question of what would have happened if one of them had needed greater care in a village that had no care services. Firstly, a needs assessment would allow for government assisted home help, provided that the asset requirements are met otherwise it is up to the individuals to foot the bill. If additional care was required at residential care or hospital level, then the couple faces separation. Transitioning from retirement village to care is often not seamless with availability often dictating that move. For those retirement villages with a continuum of care, the expectations of future availability and options need to be transparent and clearly explained.

After assisting a client to find a facility that could provide hospital level care for one spouse while also providing accommodation (in the same apartment) for an able spouse, I found that this option is as rare as hen’s teeth. There are some care suites available for couples however the waiting lists can be long. My experience is that the process of purchasing in a village and transferring within a village or to another village can be extremely difficult to understand with regard to transfer fees.

The main purpose of the Retirement Villages Act 2003 is to protect the interests of current and future residents and to enable retirement villages to develop legal frameworks that are easy to understand. The Act provides a regulatory and monitoring regime and gives powers and duties to the Registrar of Retirement Villages and the Retirement Commissioner.

The Act and related regulations and codes have not been reviewed since they were introduced 20 years ago. Over that time there has been an increasing number of retirees seeking the relative safety and companionship gained from retirement villages and this increased demand has resulted in the construction of many new villages in Tauranga and the expansion of others.

This demand has kept village prices up and villages are often only accessible to those that have a house to sell. With an increasing number of people renting into older age, there is a significant gap in the market for rental accommodation for retirees.

Serviced apartments and care suites are emerging as an option for a transition from independent living to full rest home care. These often include a small kitchen to allow some independence however, they also have options for supply of meals, cleaning and other services as required. Currently, there are small numbers of care suites available but this model may gain popularity with village operators if demand continues.

The primary aim of the review is to address issues and strike a balance between the rights and responsibilities of residents and operators of retirement villages is while also assessing whether the current Act and its parts are fit for purpose.

There are some elements of the review which will examine some of the points outlined above. These include:

Disclosure requirements on entry to the village, including:

- what is contained in disclosure statements, for example information about and support for transferring to higher levels of care

The need for:

- an independent body to oversee the complaints and disputes process to ensure transparency and accountability

Minimum standards for specific financial exit matters concerning:

- termination of weekly fees once the unit is vacated,

- resale and return of residents’ capital after exiting

- treatment of deferred management fees and capital gains and losses

The full scope of the review can be found at www.hud.govt.nz/news A discussion document is expected to be released by the Ministry of Housing and Urban Development in September 2023. Grey Power welcomes feedback from its members on retirement villages and areas where improvements can help to meet the needs of older people in 2023 and beyond.

Vanessa Charman-Moore/Tauranga & BOP Branch

Shorts

Sleep problem research: people needed. Contact pca-research@otago.ac.nz

Chat lanes at supermarkets: https://twitter.com/maartenvda/status/1612065166132400129

Don’t lift super age: https://www.stuff.co.nz/business/opinion-analysis/130999223/heres-how-we-can-have-a-sustainable-nz-super-without-lifting-the-retirement-age-from-65

Demographic timebomb: https://www.theguardian.com/world/2023/jan/22/ageing-planet-the-new-demographic-timebomb

Senior Housing That Seniors Actually Like https://nyti.ms/3wBv66L

Retirement homes: why no capital gain? https://www.stuff.co.nz/business/property/300770425/honestly-i-just-dont-know-why-i-did-it-our-oldest-population-is-losing-money-by-buying-into-retirement-villages

Google Watch has fall detection: https://blog.google/products/pixel/fall-detection-on-pixel-watch

Cheap internet deal: Skinny Jump from $5/month. See https://www.skinny.co.nz/jump/home/